Hyundai Financing Credit Score: What Do You Need?

Shopping for a new or pre-owned Hyundai in Sycamore, IL? If you’re wondering what kind of credit score you need to qualify for a Hyundai auto loan or lease, you’re not alone. Your credit score can significantly impact your purchasing options, including the types of financing or leasing deals available to you. Whether you’re a first-time buyer or rebuilding credit, Kunes Hyundai of Sycamore is here to help you navigate your financing options with confidence.

Minimum Credit Score for Hyundai Financing

Generally, to qualify for Hyundai Capital financing through a dealership like Kunes Hyundai of Sycamore, you’ll want a credit score of 650 or higher. However, Hyundai does not have a set minimum credit score requirement—approval is based on a variety of factors, and local dealership discretion plays a role. This is considered a “fair” score and may unlock competitive rates on new and certified pre-owned vehicles.

However, Hyundai does offer flexible options for a wide range of credit situations:

- Excellent Credit (720+): You’re likely to qualify for the best Hyundai finance and lease rates.

- Good Credit (660–719): Competitive interest rates and lease terms are still within reach.

- Fair Credit (600–659): You may still qualify for financing, though rates may be slightly higher.

- Bad Credit (< 600): Special subprime financing may be available through Kunes’ finance team, including Hyundai loans for bad credit.

Tip: Your score isn’t everything. Lenders also consider your income, debt-to-income ratio, employment history, and down payment.

Hyundai Financing Options in Sycamore, IL

At Kunes Hyundai of Sycamore, we work with a wide network of lenders, including Hyundai Motor Finance, to offer competitive financing—even if your credit isn’t perfect. We help customers across the Sycamore, DeKalb, and greater Chicagoland areas find solutions that fit their budget. Our convenient financing process is designed to make it easy for you to get behind the wheel with flexible options tailored to your needs.

Local financing highlights:

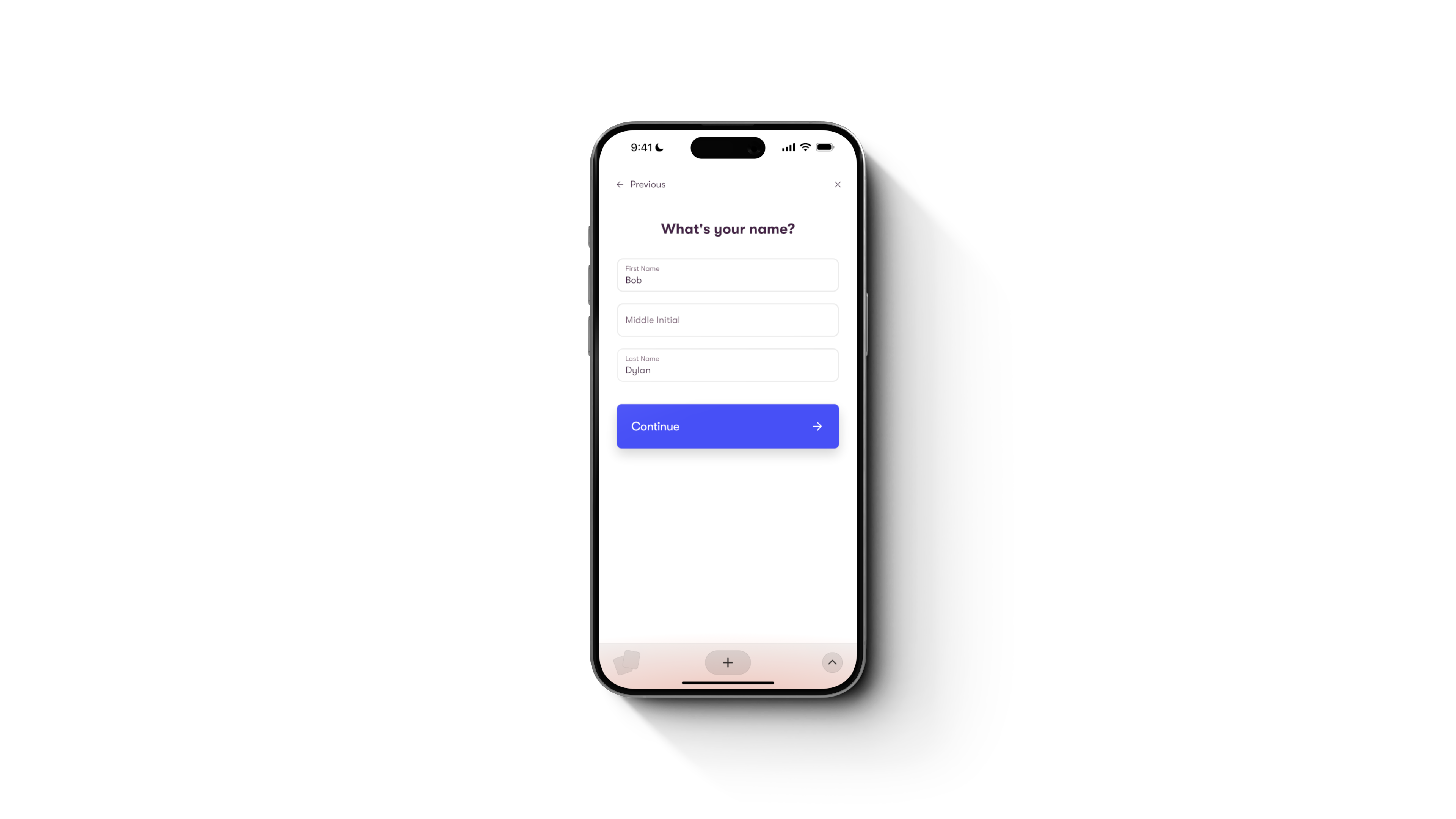

- Easy Hyundai credit application (online or in-store)

- Pre-approval without impacting your credit score

- Available first-time buyer programs

- Bad credit Hyundai loan assistance

- Credit-building options for younger or rebuilding buyers

Be sure to check our available financing programs or use our online calculators to find the best option for your needs.

Value in Every Step: Why Your Credit Score Matters

A better credit score generally means:

- Lower interest rates

- More loan approval options

- Better lease terms

- Lower monthly payments

Having a higher credit score gives you the advantage of qualifying for better Hyundai financing offers and lower interest rates. Your credit score and the APR you receive go hand in hand, so maintaining good credit can lead to more favorable loan terms.

But even if your score is low, you’re not out of the game. Kunes Hyundai can help you explore affordable options and guide you through credit improvement strategies to help get you behind the wheel faster. Improving your credit score can also increase your chance of being approved for financing.

Managing a Low Credit Score: Your Options with Hyundai Financing

Facing a low credit score can make the car financing process feel overwhelming, but you still have options when it comes to securing a car loan for your next Hyundai vehicle. At Kunes Hyundai, we understand that life happens, and your credit history shouldn’t stand in the way of driving a new car or SUV. That’s why Hyundai Motor Finance offers flexible programs designed to assist customers with less-than-perfect credit.

A low credit score may mean you’ll encounter higher interest rates, which can result in paying more money over the life of your loan. However, there are steps you can take to improve your chances of getting approved for Hyundai financing. Start by making sure you pay your bills on time, reduce outstanding debt, and avoid actions that could trigger a security service block—such as submitting malformed data or a SQL command when applying online. These steps not only help boost your credit score but also protect your information from online attacks and ensure a smooth application process.

If you’re unable to get approved for a car loan right away, don’t lose hope. The finance team at Kunes Hyundai is ready to assist you in exploring alternative solutions, such as applying with a co-signer or making a larger down payment to lower the amount you need to finance. Our team can also provide information on special Hyundai financing programs tailored for customers with a low credit score, helping you plan for the future and get back on track.

Remember, improving your credit score takes time, but every positive action brings you closer to your goal. By staying informed, taking proactive steps, and working with the supportive team at Kunes Hyundai, you can increase your chances of getting approved for a car loan—even with a low credit score. We’re here to help you find the right financing solution so you can drive away in a new Hyundai vehicle with confidence. If you’re ready to take the next step, reach out to our team today and let us assist you on your car financing journey.

FAQ: Hyundai Credit & Loan Questions

What’s the minimum credit score for a Hyundai lease?

Typically 650 or higher, but Kunes Hyundai has options for credit scores below that depending on lease terms and lender flexibility. The rates and requirements mentioned are current for this year.

Can I get Hyundai financing with no credit?

Yes. First-time buyer programs may be available. A co-signer or a solid income history may help strengthen your application.

Does Kunes offer subprime financing?

Yes. Our team works with customers with credit challenges and helps structure deals with realistic terms.

Can I apply for financing online?

Absolutely. Use our secure online credit application to get started from the comfort of your home.

Let’s Make It Happen at Kunes Hyundai of Sycamore

Whether you have excellent credit, limited credit, or some bumps along the way, the team at Kunes Hyundai of Sycamore is ready to help you finance your next Hyundai confidently. From the fuel-efficient Elantra and Tucson to the family-sized Palisade, we’re here to make your next vehicle—and your monthly payment—fit your lifestyle.

Start your credit application today or visit our dealership in Sycamore to talk to a Hyundai finance expert.

Get pre-qualified in just a few taps

When you're searching for the perfect vehicle, it helps to know if you qualify for the financing you need. Get pre-qualified in just a few taps, with no effect on your credit score.